2023 Levy Ballot Measure

The Independence School District’s Levy Ballot Measure passed on August 8, 2023 with a 70% approval rating.

This measure allows the district to increase operational funds, which will:

- Improve staff salaries & benefits

- Create additional staff positions

- Help fill hard-to-staff positions

How does it work?

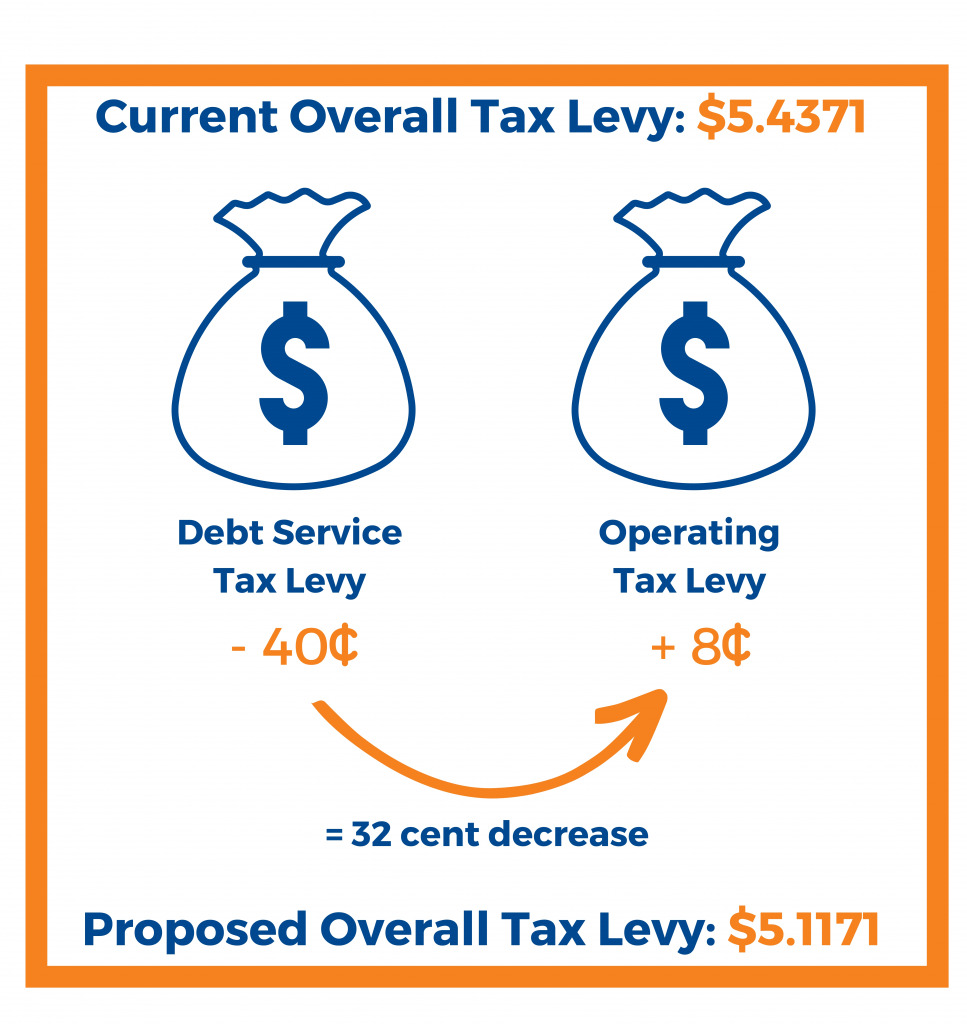

The Independence School District is funded through a combination of federal, state, and local funding (i.e. property taxes). Local property taxes are utilized by the school district through an Overall Tax Levy Fund that is made up of two parts, the Debt Service Tax Levy and the Operating Tax Levy.

The August 8, 2023 Levy Ballot Measure asked if the ISD can raise the Operational Levy 20 cents, which increased money available for salaries & benefits.

The Board of Education will not increase by the maximum of 20 cents, but instead has committed to only increase the Operating Levy 8 cents.

The district will lower the Debt Service Levy 40 cents. This will mean a decrease to the Overall Tax Levy of 32 cents, resulting in the district’s levy going from $5.4371 to $5.1171.

Click here to access a PDF version of Frequently Asked Questions.

Ballot Language

The question language on the August 8, 2023 ballot appeared as follows:

“Shall the Board of Education of The School District of the City of Independence, Missouri be authorized to increase the operating tax levy ceiling to $4.3190 per $100 of assessed valuation according to the 2023 assessment for the purpose of increasing salaries and benefits for employees?

“If this question is approved, the operating tax levy of the District is estimated to increase by $0.20 per $100 of assessed valuation, and the District expects to make a voluntary reduction to its debt service tax levy by $0.30 per $100 of assessed valuation resulting in the estimated overall tax levy of the District to be decreased by $0.10 per $100 of assessed valuation.”

Frequently Asked Questions

What is a property tax levy or levy?

A property tax levy or levy is the amount of property tax dollars a school district

requests as one of its primary sources of funding. A levy must be passed by voters in a school district. In the ISD, the Overall Tax Levy is divided into two parts: Operating Levy and Debt Service Levy.

What is an Operating Levy?

The Operating Levy pays for the district’s operating expenses. Voters must approve any increase to a levy in a local election. Once a levy rate has been passed, it continues to generate approximately the same amount of money every year. It will not expire, and it does not need to be renewed.

What is a levy ballot measure?

A ballot measure is an issue or question that appears during an election for voters of a jurisdiction to decide. The ISD Board of Education approved the ISD adding this proposed levy change to the ballot for a special election on August 8, 2023.

Why is the ISD putting a levy measure on the ballot?

To increase staff salaries & benefits, create additional staff positions, and help recruit employees for hard-to-fill positions.

Why is an Operating Levy important for a school district?

Property taxes are one of the primary funding sources for school districts. A district relies on a property tax levy, either through extending a current levy or by a levy increase, to match revenues with increasing expenditures such as employee salaries and benefits, services, and materials.

What is a Debt Service Levy?

The Debt Service Levy pays for the principal and interest on bonds, notes, or other

forms of debt owed by a school district that the district has issued to pay for new

buildings and improvements that have been approved by voters in a bond issue.

What is a levy rate?

A levy rate is the amount of property tax per $100 of assessed property value to fund a voter-approved levy amount. A levy rate of $1.00 means that for every $100 of property value, the owner of the property will have to pay $1.00 in taxes.

What is the ISD’s current tax levy rate?

2023 Fiscal Year:

Operating Levy $4.1190

Debt Service Levy $1.3181

Assessed Valuation $1,272,676,041

At a 92.90% collection rate, the ISD generated $48,699,179.

What does the August 8th, 2023 ballot measure + ISD BOE commitment propose?

The August 8th, 2023 ballot measure asks voters to give the ISD Board of

Education the authority to raise the Operating Levy 20 cents. If the measure

passes, the BOE will only actually raise the Operating Levy 8 cents.

The ISD BOE has committed to lowering the Debt Service Levy 40 cents. This will

not increase the interest rate on the district’s debt, nor will this move cause the

district to default on its debt.

The approval of the levy ballot measure and the BOE’s commitment will result in an

Overall Tax Levy decrease of 32 cents. The ISD’s Overall Tax Levy will go from $5.4371

to $5.1171.

Proposed 2024 Fiscal Year:

Operating Levy $4.1190 (+ 8 cents) $4.199

Debt Service Levy $1.3181 (- 40 cents) $0.9181

Assessed Valuation $1,635,110,960 (prior to the outcome of current AV protests)

Why is the ballot language different from what the BOE has committed?

By the time the ballot language was due to the Election Board, the district did not

have the latest Assessed Valuation numbers. The ballot language reflected what the district was estimating the levy needed to be based on prior information.

How much will this ballot measure (increase to the operating levy)

generate for the Independence School District to use for staff raises?

We estimate this will generate between $9 and $10 million. This will be dependent

upon the final property tax revenues received once the county has completed all

Board of Equalization appeals.

If the ballot measure is approved and the BOE upholds its commitment, how will the funds be used?

The funds generated will go directly and only toward increased staff salaries and

benefits, the creation of new staff positions if needed, and the increased ability to fill hard-to-staff positions.

If the ballot measure is approved and the BOE upholds its

commitment, when will district staff see salary increases?

Salary increases would begin for the 2024-2025 school year. Salary schedules will be finalized in the Spring of 2024 once negotiations are completed with each of the unions.

How does the ISD’s tax rate compare to other school districts?

2022-2023 Total Levy

| District | Levy |

|---|---|

| Fort Osage | $6.3700 |

| Raytown | $6.3200 |

| Blue Springs | $6.1438 |

| Liberty | $5.9277 |

| North Kansas City | $5.6945 |

| Lee’s Summit | $5.4662 |

| Independence | $5.4371, Proposed: $5.1171 |

| Park Hill | $5.3955 |

| Kansas City | $5.2461 |

What will happen if the levy ballot measure is not passed on August 8, 2023?

Due to the high number of Assessed Valuation protests that are occurring, if this

does not pass, the ISD will likely receive less in tax revenue than it did in the

2022-2023 school year.

Independence School District, 201 N Forest Ave, Independence, MO 64050